Many mortgage issuers often wonder why members of the Federal Open Market Committee (FOMC) feel compelled to publicly discuss interest rates almost daily, appearing on television and in other media outlets, even during weekends. Unfortunately, the answer seems to lie in the belief that creating confusion is somehow beneficial for confidence, an essential but intangible component for financial stability.

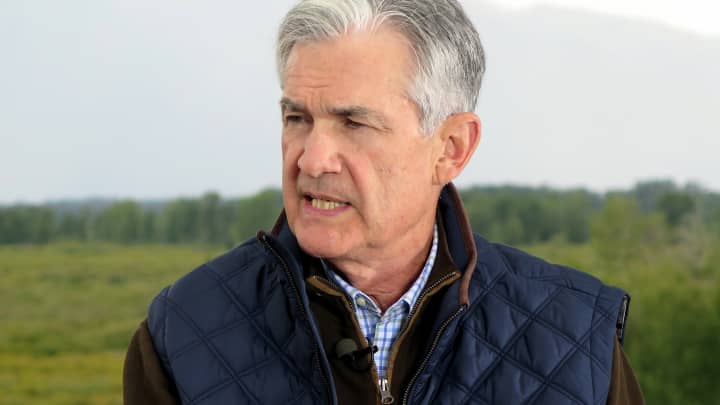

Economist Komal Sri Kumar pointed out the sudden shift in Chairman Jerome Powell’s stance just two weeks after suggesting that inflation was gradually moving towards the Federal Reserve’s 2% target during a speech at Stanford University. This unexpected change left many investors who had taken the Chairman’s previous remarks at face value feeling disappointed.

Despite mortgage rates rallying from October to the first quarter of 2024, lenders are now facing the challenge of rising mortgage rates and potentially lower volumes ahead. However, with the Fed Funds target at 5.25% to 5.5%, increasing loan coupons could result in improved profitability, offering a positive spread between coupons and warehouse finance costs.

The Basel III proposal’s plan to double the credit conversion factor on committed warehouse lines has sparked criticism, especially considering its potential impact on the unused portion of such commitments. Additionally, as lenders start to see positive spreads over funding costs for the limited purchase loans available, federal bank regulators might further restrict bank warehouse lines, thereby reducing market liquidity.

Mortgage lenders are primarily focusing on purchase volumes as the main opportunity in the current market landscape. Although these loans incur significant expenses, with a total cost of over $12,000 per loan according to the Mortgage Bankers Association, rising mortgage loan coupons may lead to some lenders breaking even or achieving positive carry before selling the note.

Despite rising mortgage rates, many lenders experienced increasing loan volumes and improved gain-on-sale margins in the first quarter, as consumers seeking housing solutions continued to make purchases. However, lenders with large servicing portfolios are still finding ways to generate new volumes, underscoring the ongoing importance of recapture in MSR pricing.

The Fed’s initial action to slow the rate of runoff of the central bank’s Treasury portfolio could be seen as a de facto rate cut, as it results in more reserves and potentially increased demand for loans and MBS by banks. However, with the U.S. approaching a contentious general election and signs of rising inflation, the FOMC is unlikely to change the federal funds target until at least December, potentially leading to higher market interest rates due to increased U.S. Treasury debt issuance.

Furthermore, despite the rise in mortgage rates, concerns about lower home prices are growing, with 40% of respondents in a recent survey expecting home price declines in 2024. However, overall, the lack of new affordable housing is keeping single-family prices firm, although inflation in housing-related costs remains a limiting factor.

Given the FOMC’s track record under Chairman Powell, investors and lenders are increasingly frustrated with the lack of clarity and consistency in interest rate policy communication. The Committee’s reluctance to adjust its post-meeting statements despite changing economic conditions risks rendering its communication ineffective.

In conclusion, the uncertainty surrounding the Fed’s messaging on interest rates is leaving investors and lenders in a state of confusion. If the Fed cannot provide clear guidance on future interest rates, it raises questions about the effectiveness of its communication strategy.