Nvidia’s remarkable performance has been a major driving force behind the S&P 500’s upward trend this year, contributing to roughly a quarter of the index’s overall gains. There was considerable anticipation surrounding Nvidia’s financial report released on Wednesday, with some investors and analysts likening its impact to the significance of inflation data releases.

In its fourth-quarter earnings report, Nvidia exceeded expectations. Earnings per share reached $4.93, surpassing analysts’ estimates of $4.59. Moreover, the company reported a staggering 770 percent increase in net income, totaling $12.3 billion, which exceeded analysts’ expectations of $10.4 billion.

Originally known for its gaming graphics cards, Nvidia has evolved into a pivotal player in the AI sector. Major tech giants like Alphabet, Microsoft, Amazon, and Meta have significantly ramped up their investments in AI computing. Nvidia’s chips, particularly the H100, have become the industry standard for AI development, leading to advancements in generative AI technology, including chatbots and other software capable of learning and generating content.

The rising popularity of OpenAI’s ChatGPT has fueled demand for Nvidia’s H100 chips, making them highly sought-after in Silicon Valley. For instance, Meta plans to expand its H100 chip inventory to 350,000 units by 2024. Currently, supply constraints rather than demand are the primary factors limiting Nvidia’s growth in the short term.

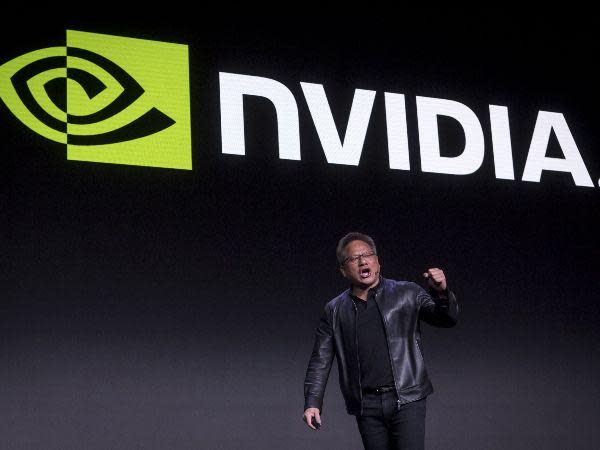

During a call with investors, Nvidia’s CEO, Jensen Huang, emphasized the company’s pivotal role in enabling generative AI, describing its chips as “essentially AI-generation factories” driving a new industrial revolution. He underscored the widespread adoption of generative AI across various industries as a fundamental aspect of their operations.

While Big Tech companies remain Nvidia’s primary revenue source, the company has witnessed diversification in its customer base. Industries such as automotive, financial services, and healthcare are increasingly investing in Nvidia’s chips for AI computing. Additionally, sovereign nations like Japan, Canada, and France are emerging as significant Nvidia customers as they leverage citizen data to develop their own AI models.

Nvidia’s data center division has emerged as its primary revenue driver, generating $18.4 billion in revenue in the fourth quarter, marking a remarkable 409 percent increase from the same period last year. Gaming chips also contributed significantly with $2.9 billion in sales.

Investors are closely monitoring Nvidia’s ability to sustain its impressive growth rates, especially as it shifts focus to new products like the B100, its top-end AI chip expected to launch later this year. The company faces increasing competition, including the development of AI chips by some customers and challenges in the Chinese market due to new US export regulations.

Despite these challenges, Nvidia’s latest results have been met with enthusiasm from analysts, with some describing it as an “insane” achievement. However, there are concerns about the company’s ability to consistently surpass expectations in the future, indicating that replicating this extraordinary quarter could pose challenges.