Warner Bros. Discovery (WBD) faced a turbulent market environment as its shares plummeted by 10% following the release of its fourth-quarter earnings report. Despite delivering commendable free cash flow and making substantial strides in reducing debt, the company encountered unexpected declines in revenue and earnings from its studio and linear networks divisions.

The studio and linear networks, traditionally pillars of WBD’s profitability, experienced sharper declines than anticipated. This was exacerbated by strikes from actors and writers unions during the October-December period, resulting in a 30% drop in adjusted studio earnings and a 9% decline in revenue.

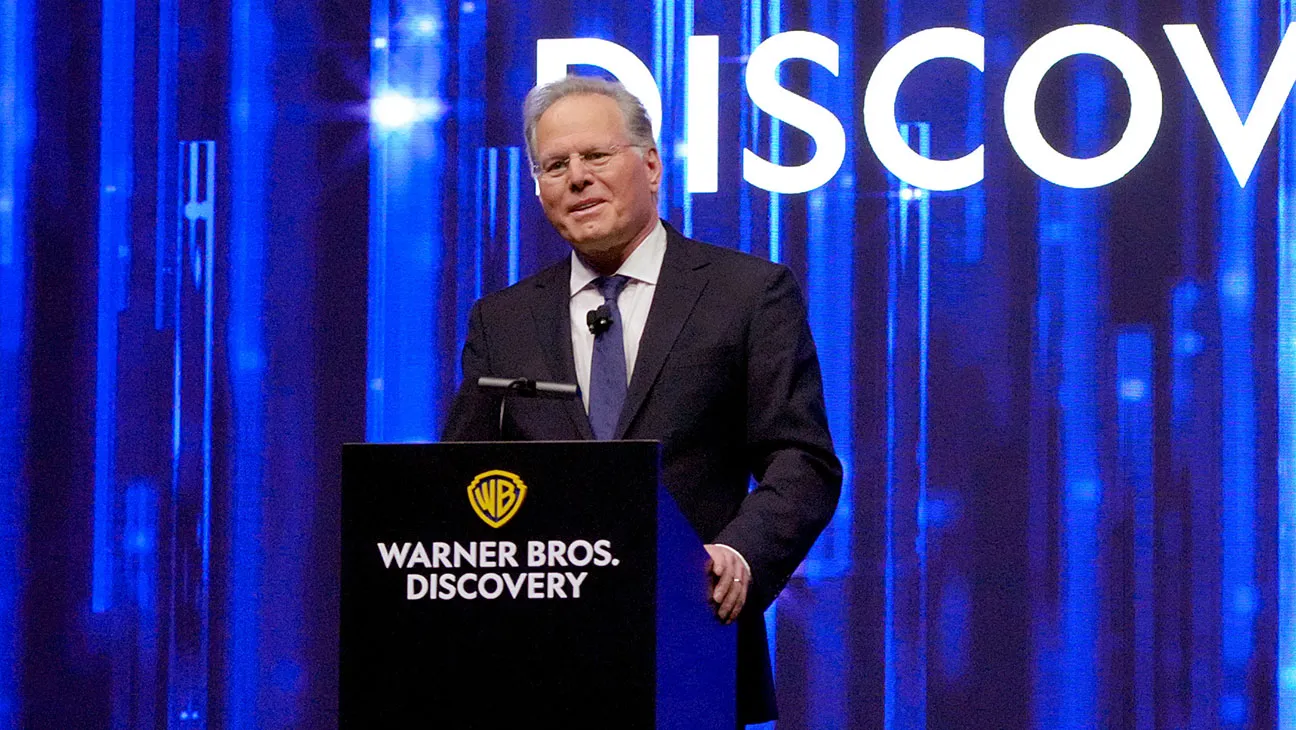

CEO David Zaslav acknowledged the challenges, attributing them to ongoing disruptions in the pay TV and linear advertising ecosystems. However, he maintained optimism for WBD’s prospects in 2024, stressing the importance of innovative solutions to address industry challenges.

While speculation about potential mergers continues, Zaslav emphasized WBD’s unwavering commitment to HBO Max and its creative assets. Despite setbacks, there were positive developments, including a reduced loss for HBO Max and significant free cash flow generated by legacy businesses.

Concerns lingered about the underperformance of Warner Bros. studio and the sluggish growth of HBO Max subscribers. Zaslav underscored the significance of bundling and international expansion to drive future growth, expressing confidence in the upcoming content lineup, featuring highly anticipated titles like the “Joker” sequel and “Harry Potter” TV series.

In conclusion, despite market challenges, Zaslav and his team remain resolute in their optimism about WBD’s future. Through strategic initiatives and adaptation to industry shifts, WBD aims to navigate the volatile entertainment landscape successfully and sustain its growth trajectory.