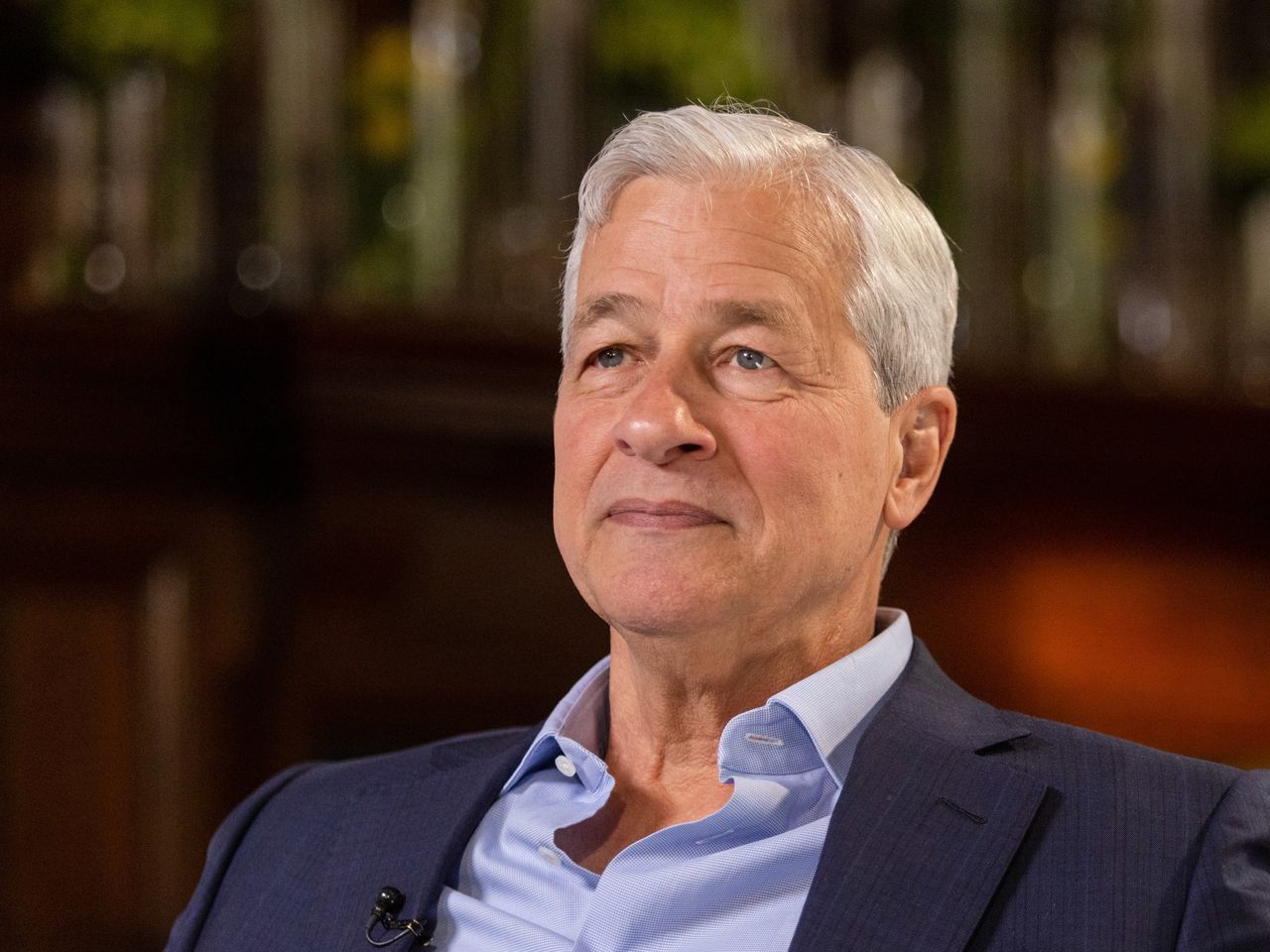

Jamie Dimon, the long-standing CEO of JPMorgan Chase & Co., has made headlines with his decision to sell approximately $150 million worth of the bank’s stock, a move he announced last year, marking his first such sale in his 18-year tenure.

Dimon, along with his family, executed a series of transactions on Thursday, selling around 822,000 shares, as reported in a filing with the U.S. Securities and Exchange Commission. Despite the sale, JPMorgan’s stock continues to trade at a record high, demonstrating its strong performance relative to the broader market and its peers.

In an October filing, JPMorgan reiterated Dimon’s confidence in the company’s future prospects, emphasizing that his ownership stake in the bank would remain significant. However, the company declined to provide additional comments on the recent stock sales.

The October announcement outlined Dimon’s plan to sell up to one million shares, subject to the terms of a prearranged stock-trading plan. Even after the recent transactions, Dimon and his family still retain approximately 7.7 million shares in the company.

JPMorgan’s robust performance in the past year, buoyed by strategic moves such as its acquisition of First Republic Bank, has contributed to a 27% increase in its stock price. Since Dimon took the helm as CEO, the bank’s stock has experienced substantial growth, soaring from around $40 at the start of his tenure to nearly $183 per share at the time of the recent sales.

Despite the stock sale, analysts on Wall Street remain optimistic about JPMorgan’s future prospects, giving it the highest consensus rating among major banking peers. Their price targets suggest a potential return of over 4% in the next twelve months, reflecting confidence in the bank’s continued success under Dimon’s leadership.