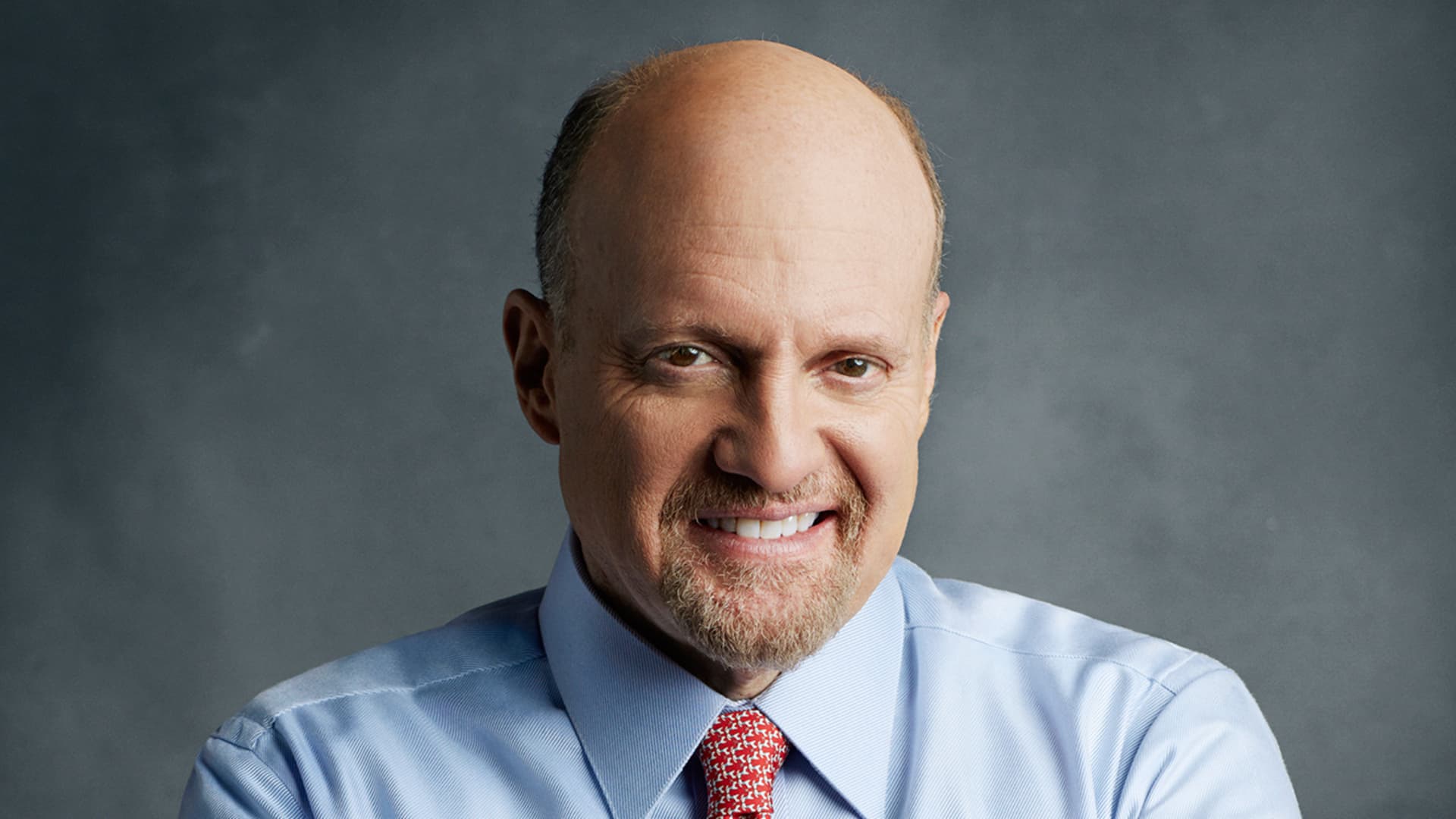

According to CNBC’s Jim Cramer, the recent market sell-off may have come to a halt, as evidenced by Monday’s rally in the averages. Cramer expressed optimism, suggesting that “maybe the worst is behind us.”

Highlighting the losses seen in several tech companies over recent months, Cramer specifically mentioned Nvidia and Microsoft. Nvidia’s stock faced pressure amidst concerns about the Federal Reserve’s upcoming interest rate decision, despite the company’s announcement of a promising new graphics chip. On the other hand, Microsoft experienced a rally following strong earnings and success in its cloud business, but still saw a decline alongside the broader market. Cramer noted that both stocks have since rebounded.

While some may perceive Cramer’s focus on these tech declines as cherry-picking, he clarified that he is examining equities that were previously considered “the great growth stocks of the era” until the market dynamics shifted in early March.

Reflecting on the recent market turbulence leading up to the Fed meeting and throughout earnings season, Cramer acknowledged significant losses that may have prompted investors to consider exiting the market altogether.

When reached for comment, Nvidia declined to respond, while Microsoft did not immediately offer a statement.