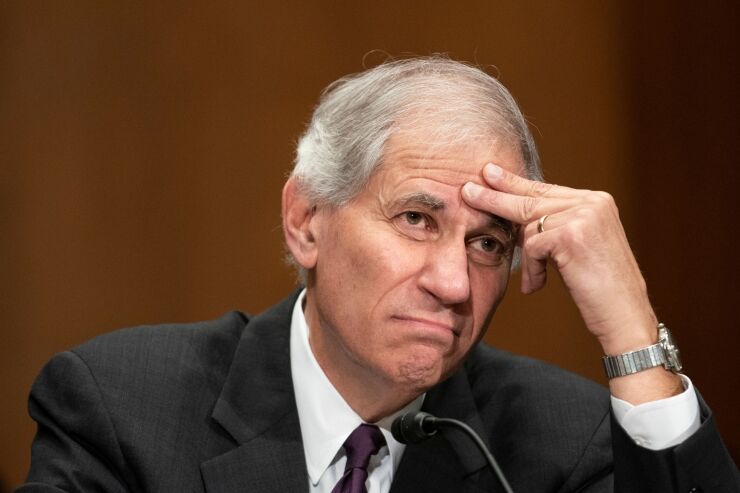

Lawmakers are urging Martin Gruenberg, chair of the Federal Deposit Insurance Corporation (FDIC), to step down following the release of a damning report revealing widespread sexual harassment, discrimination, and bullying within the agency. The 234-page report, conducted by Cleary Gottlieb Steen & Hamilton and commissioned by the FDIC, echoes the findings of a previous Wall Street Journal investigation, highlighting a deeply ingrained toxic culture. While the report doesn’t solely blame Gruenberg, it acknowledges that the agency’s culture starts at the top.

Instances of Gruenberg’s temperamental outbursts, particularly in response to bad news, are documented in the report, causing staff to hesitate in delivering upsetting information. This behavior, according to the report, may impede his ability to foster trust and lead effective cultural change within the organization. Gruenberg has yet to respond to the report, but an FDIC spokesperson stated that he is already implementing its recommendations.

Calls for Gruenberg’s resignation have been predominantly from Republican lawmakers, with only one Democratic representative joining the chorus. This reluctance from Democrats may stem from the potential consequences of Gruenberg’s resignation. If he were to step down, Vice Chair Travis Hill, a Republican appointee, would assume the role until a successor is appointed and confirmed. This could result in a deadlock within the agency’s board of directors, hindering rulemaking and regulatory initiatives.

Analysts suggest that Gruenberg’s departure could benefit larger banks, as it may lead to a slowdown in regulatory efforts such as Basel III Endgame, which seeks to increase capital requirements for major banks. However, despite the calls for resignation, it remains uncertain whether Gruenberg will step down, especially since key progressive figures like Senator Elizabeth Warren have not demanded his resignation. Additionally, there’s no indication from the White House that President Biden questions Gruenberg’s leadership abilities.

Concerns have been raised about Hill’s ability to respond effectively to potential banking crises, given his lack of experience in leading the agency during such events. Despite his role as second-in-command during last year’s crisis, there are doubts about his readiness to handle similar situations in the future.