According to the CNBC Fed Survey, there’s a noticeable gap between what respondents expect from the Federal Reserve and what the market anticipates in terms of interest rate cuts. While traders are gearing up for aggressive rate reductions starting as early as March, survey participants are more reserved, with only a small fraction predicting cuts in March and the majority forecasting them for May or June.

This discrepancy sheds light on differing opinions regarding the economy and the Fed’s response. Some economists, like Joel Naroff, suggest that the Fed is unlikely to make significant rate cuts unless there’s a clear slowdown in the economy. They argue that premature easing could jeopardize the progress made in controlling inflation while risking economic stability.

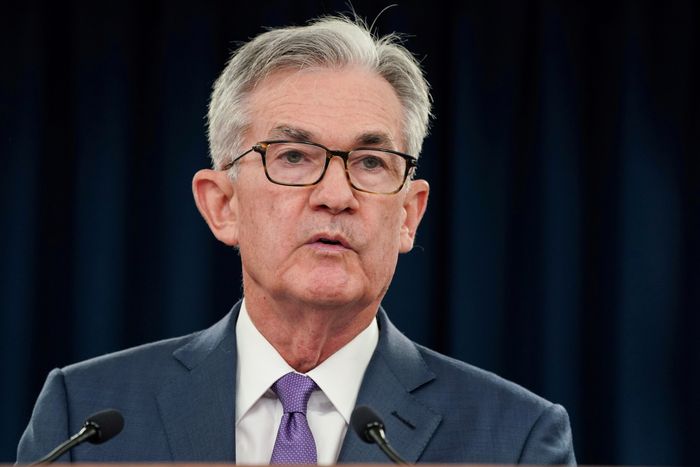

As investors eagerly await the Fed’s interest rate decision, all eyes will be on Fed Chief Jerome Powell’s remarks during the subsequent news conference for clues on the central bank’s future moves. While survey participants typically align more closely with the Fed’s stance, there’s ongoing debate about how quickly the Fed will adjust rates and whether it will match market expectations.

Looking ahead, both the market and survey respondents converge with Fed forecasts on a funds rate between 3.3% and 3.6% by 2025. However, the focus now shifts to the timing and pace at which the Fed will reach this target, raising questions about potential market reactions.

In terms of economic outlook, respondents express a preference for a proactive Fed, with many believing that the risk lies in the central bank cutting rates too late rather than too early. There’s also disagreement on the Fed’s plan to reduce its balance sheet, with concerns about its size relative to bank reserves.

Despite predictions of a slowdown in economic growth, forecasts are less pessimistic compared to the previous year. Economists point to various factors influencing the outlook, including geopolitical tensions and the upcoming presidential election. While risks remain, there’s a growing sense of confidence in the economy’s resilience.

In summary, the CNBC Fed Survey highlights cautious optimism tempered by uncertainties surrounding monetary policy and economic conditions. As stakeholders await the Fed’s decision and navigate future developments, the debate over the appropriate course of action continues.